Bitcoin Is The Greatest Social Network

How The Winklevoss Twins Became Bitcoin Billionaires · 5 min read

Welcome to Super Simple — the best way to go down the Web3 rabbit hole

Short summaries of curated content. No external links. No biases. < 5 mins. Free

Hello

This post is a summary of the interview by Raoul Paul with guests Cameron and Tyler Winklevoss on The Real Vision Finance channel, posted on Dec 20201.

You have probably heard of the Winklevoss twins due to their association with Facebook. But they are also some of Bitcoin’s earliest high profile supporters. Additionally, they built Gemini, one of the earliest cryptocurrency exchanges.

In this episode, they talk about what excites them about Bitcoin and where they see it going. This is by no means their complete thesis. However, the exuberance they have for the asset is evident.

In short, they still think its the ‘trade of the decade’. They have been holders for 9 years through multiple periods of crazy swings. Even when prices dropped 90%, they held firm because of their core thesis.

Of course, this is not financial advice by them. As always, plenty of the summary is plagiarized and paraphrased. Even quotes.

All credit goes to Raoul Paul, Cameron and Tyler Winklevoss and Real Vision. Links to all source content can be found at the end.

Read Time: 5 minutes

Time Saved: 1 Hour 0 Minutes

Prerequisites: Bitcoin (Need a refresher? Start with the basics here)

Bitcoin Is The Greatest Social Network Of All

Catching The Bitcoin Bug

The Winklevoss twins were first told about Bitcoin in 2012 by someone who happened to recognize them from The Social Network while on vacation in Ibiza2.

They began to think of Bitcoin as a money network, akin to a social network.

The big aha moment was the ability to send money like sending email

They also looked at Bitcoin through the framework of being digital gold. The properties of Bitcoin mirrored gold as a store of value, while also being divisible, portable and easier to store.

Their first purchase was when Bitcoin’s price was still in the high single digits and the market cap was <$100M (At the end of 2021, Bitcoin market cap was 10000 times that = ~$1 Trillion).

Coincidentally, Raoul’s journey in to Bitcoin also began in Spain in 2012, when the Euro banking system had collapsed. He had a round table with other ‘macro guys’ i.e. other investors focused on macroeconomic strategies about what to do and where to allocate. One of them suggested that the answer Raoul was looking for is Bitcoin.

Why Bitcoin

(To reiterate, this is not a comprehensive version of their thesis, just the points discussed in their interview)

The Bitcoin community in the early days was full of “the smartest guys in the room”

Everything is digital now. ‘Hardware’ money must also go online

Bitcoin was the first money built for the internet. Not for the bankers

(Credit cards came before the internet. Yes they are usable on the internet but they are a square peg for a round hole)

Bitcoin can dethrone gold as a store of value

Has even greater promise than gold because a lot of people can’t get access to gold but can access bitcoin

Developing world is where crypto is really needed in a big way

The US is pretty privileged to have a good fiat currency but in countries like Zimbabwe, Venezuela, Argentina wealth often gets destroyed with high inflation and defaulted currencies3

For over the billions in the world who are unbanked, cryptocurrencies represent a solution

“We just couldn’t figure out a way it wouldn’t work”

There is an inevitability to it all, just like there is about the internet

This applies to their view on Bitcoin’s longevity as well

“To shut down bitcoin you have to shut down the internet”

Bitcoin Has Network Effects

What Are Network Effects

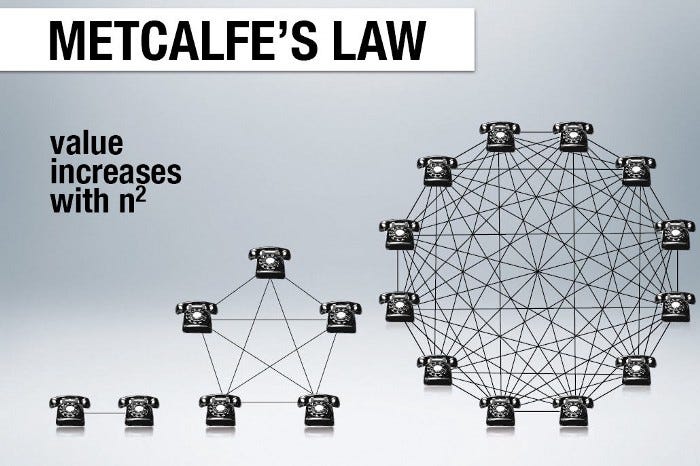

A network effect is the phenomenon in which a new user joining a given network increases the value of that network for other users

Said differently, new users make it more attractive for other potential users to join the network

For instance, the more people who have a phone, particularly the more of your friends, the more valuable the phone it is to you

Similarly, the more people that believe in Bitcoin and are willing to accept it, the more incentive there is for a new participant to buy it.

It becomes hard to unseed well-established networks. Their users become their champions. There is a lot of lock-in.

As we have seen with networks like Facebook, even the almighty Google couldn’t usurp them (the failed Google Buzz and Google+)

Users don’t want to move away and have to upload their photos again or build their connections, followings, social-proof again

Raoul: you couldn’t build a better incentive for a network than money

Tyler: Exactly, people on other networks are working for retweets and likes. People here are working for value

Valuing Network Effects

Network effects make Bitcoin immensely attractive as an investment. Adoption grows the value of the network exponentially.

The way you value networks is Metcalfe’s law. This is different from Wall Street valuing a cash producing company linearly proportional to its earnings.

Metcalfe's law — the value of a telecommunications network is proportional to the square of the number of connected users (n squared). It’s exponential.

Can you picture why? For eg. A 2 phone network can make only 1 connection, 5 phones can make 10 connections, and 12 phones can make 66 connections.

Institutional Investors Are Coming To Bitcoin

Bitcoin Can No Longer Be Ignored

Cryptocurrencies have primarily been a retail investor phenomenon so far.

Sophisticated investors and money managers were not allowed to buy Bitcoin in their funds but have been quietly buying Bitcoin in their personal accounts. Only some have been vocal about it.

This is starting to change. Famous investors like Paul Tudor Jones and Stan Druckenmiller invested in Bitcoin.

Ironically, some institutions had to wait for the market cap to go higher, since they couldn’t take large positions that would reflect a significant percentage of the total traded volume

The trade of the century is still out there for hedge fund managers

- Tyler Winklewoss

Raoul: Institutions simply have to come in. There is a reflexive loop that comes in to play. Thanks to Bitcoin being the best performing asset class, the market cap is now investable by institutions. Which drags in institutions. Which raises market cap, and further drags in more institutions.

Beyond Institutional Investors - Central Banks And Public Companies

Cameron: The dominoes are starting to fall. Currently, central banks are stocking up on gold because they understand the inflationary risk on their monetary supply.

One day, not too far from now, not just institutions but central banks will stock up on bitcoin.

Just like Michael Saylor who bought Bitcoin as a treasury asset for the publicly traded company Microstrategy4, other companies will need Bitcoin in their treasuries to preserve value.

Can Central Bank Digital Currencies Usurp Bitcoin?

Digital currencies launched by central banks, while not here yet, also seem inevitable. Can they coexist with cryptocurrencies?

CBDCs are just different a form of fiat money

Money has been the domain of governments for a long time. Of course they don’t want to cede control to crypto

Ultimately, fiat money needs disruption

12 entities behind a closed door control the US Federal Reserve, decide what to do and then use elite bankers to distribute it

Even if CBDCs were to come, the fact that bitcoin is decentralized and not coming from the government is great

At least its competition. People can have choices. Which is much needed in countries with government having monopoly on increasingly worthless fiat

The Tokenization Of Everything Is Inevitable

Bitcoin is analogous to digital gold. Ether is analogous to digital oil. But all other assets will also eventually be on the blockchain - stocks, real estate, baseball cards, everything.

It is becoming clear that physical nature of an asset is a bug, not a feature. However, the disruption might be slow and take a while. After all, the majority of voting in the 2020 US election was still done by snail mail! With hand drawn signatures!

Let’s keep up the journey down the rabbit hole.

Next, see the summary of the interview of Vitalik Buterin, the co-founder of Ethereum, the 2nd largest cryptocurrency in the world on the Lex Fridman podcast. Vitalik is widely recognized as a genius and you can clearly see why. He breaks down core concepts such as money, Bitcoin, consensus and more.

Was This Helpful?

This quick check-in would be very valuable and will only take a few seconds.

Click on the appropriate option, and you can even see what other’s have voted.

Did the summary make you more likely to watch the episode?

1. More Likely

2. Less Likely

4. Was Never Going To Watch The Whole Episode

5. Was Going To Watch The Whole Episode Anyway

Appendix

My Two Cents

//There is hardly anything covered about Gemini, the crypto exchange founded by the Winklevoss twins in this summary as it is not core to understanding Web 3 or Bitcoin. You can learn more about Gemini here

//As bullish as they are on bitcoin, they clarify that this isn’t investment advice. Even as an informal suggestion, when it comes to holding Bitcoin they say: Prepare to hold it for 5-10 years. Don’t get in if its not your time horizon.

//I recognize their conflict of interest in evangelizing Bitcoin. This is true anytime someone is publicly exuberant about an asset they are long. But even more so in the case of Bitcoin considering their own narrative of its value. After all, the Bitcoin narrative needs to propagate for its network effects to work.

Source

Interviewer - Raoul Paul, Global Macro Investor and Founder, Real Vision Guests - The Winklevoss Twins, Founders, Gemini Exchange

Additional Sources and Readings

Footnotes

Link to episode. See Source above for additional information

Documented in the book Bitcoin Billionaires. See additional sources above

Footnote: Turkey in Dec 2021 was a recent high profile example of this